Council brings fire department in house; explores November ballot referendum

- Home

- Council brings fire department in house; explores November ballot referendum

Council brings fire department in house; explores November ballot referendum

By Kim McDarison

The Whitewater Common Council Thursday approved an agreement, bringing the city’s fire and EMS services in house.

The agreement was adopted unanimously during a special joint meeting of the council and Whitewater Fire Department, Inc., the nonprofit organization that, until Thursday’s decision, provided the city and several surrounding communities with fire and EMS services.

The agreement was approved by a 5-0 vote. Council members Jill Gerber and Gregory Majkrzak were not in attendance.

Thursday’s agreement places Whitewater Fire Department, Inc., staff on the city’s payroll effective Saturday, which is the beginning of the city’s pay period.

Also discussed Thursday was the need for an increase in funding to support the in-house department.

Whitewater Director of Finance Steve Hatton shared several slides depicting various financial scenarios.

He and Whitewater City Manager Cameron Clapper recommended that council consider the placement of a referendum question on the November ballot to support budgetary shortfalls. A potential amount of $700,000 was discussed for ballot placement.

On Thursday, both Hatton and Clapper told Fort Atkinson Online that the amount was a best estimate and could change as more information was gathered to form a referendum question.

Clapper described the formulation of a referendum question as “a work in progress.”

Department overview

Before the agreement was approved, the council received a financial update relating to expenses associated with bringing fire and EMS services in house.

Aided by slides, Hatton told those in attendance at the joint meeting that the move to bring the services in house was made to help alleviate increasing difficulties with staffing faced by the department when using a paid-on-call model.

With staffing constraints, he said, Whitewater was often forced to seek mutual aid from neighboring departments, putting additional stress on those departments’ manpower and assets.

Plans associated with bringing the department in house called for the use of a paid-on-premises model, which would improve the department’s response times and improve its ability to recruit manpower, Hatton said.

The new model would also provide department employees with health and retirement benefits and produce a schedule with more reliable hours, he said.

As part of the agreement, the Whitewater Fire Department, Inc., or WFD, Inc., would be preserved to function as a fundraising organization for the department and would maintain a fund balance to help support services and pay for capital costs associated with purchasing and replacing equipment.

The fundraising tool could also be used to help pay some operational costs as appropriate, Hatton said.

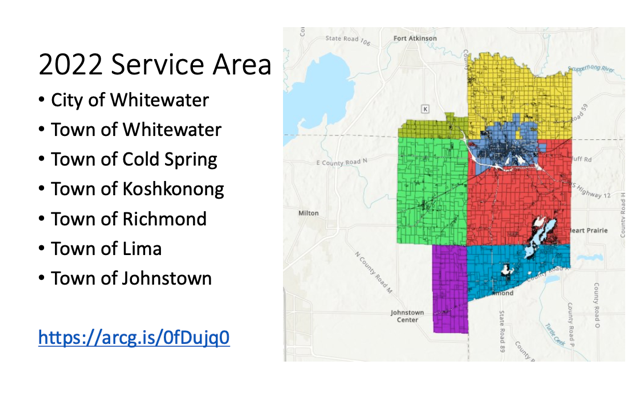

Included within his presentation, Hatton shared a slide showing the department’s service area, which, he said, includes the city of Whitewater and the towns, in part or full, of Whitewater, Cold Spring, Koshkonong, Richmond, Lima and Johnstown.

Hatton also shared a timeline of events, noting that WFD, Inc., notified the city of its intent to develop a new agreement in June of last year.

In October of last year, WFD, Inc., requested $526,000 from the city’s budget. A special meeting was held in October, and the city and WFD, Inc., began sharing ideas to integrate the department as part of city-operated services. Meetings with the towns that contract services from the fire department, the city, and WFD, Inc., were held in November 2021.

The membership of WFC, Inc., voted to accept a proposal for integration with the city in January, which was followed by approval by the city council of a memorandum of understanding for integration in April.

Thursday saw the adoption of the final agreement.

Looking at staffing levels within the department, Hatton said “at transition,” the department has four EMTs on duty 27/7 and two ambulances available to respond to calls for service. The department was staffing a total of 34,944 annual hours, he said.

Firefighters received active pay for calls and on-call pay when responding to calls on nights and weekends.

In addition, Hatton produced a slide showing per hour wages paid to firefighters and EMS staff. Hourly wages for firefighters stared at $13.65 and increased depending on training and rank within the department. The fire chief was the highest paid staff member at $24.55 per hour. On the EMS side, transport drivers and trainees earned a per hour starting wage of $7.25 which increased with level of training to a maximum of $22 per hour.

Hatton further produced a slide that offered three staffing alternatives that could be used to cover service hours.

A slide, as provided within a presentation made Thursday by Whitewater Director of Finance Steve Hatton, shows the service area of the Whitewater Fire and EMS department.

A slide shows the Whitewater Fire and EMS Department’s staffing model “at transition.”

Budgets

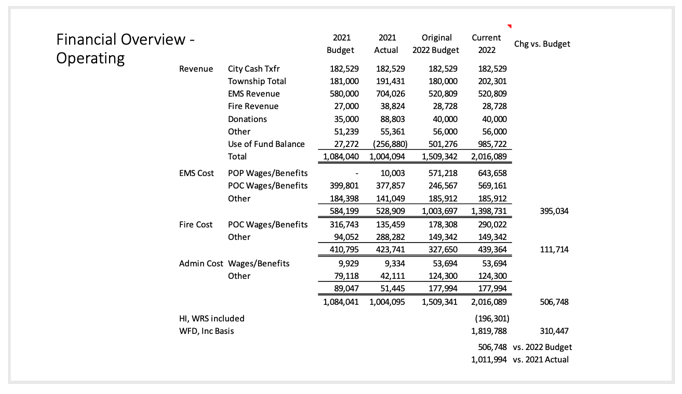

Looking at the department’s financial overview, Hatton said that in 2021, the department had an operating budget of $1.084 million, with actual costs that year coming in at $1.004 million. This year, the department began the year with an operating budget of $1.5 million, with expenses running at $2.01 million.

He attributed changes in the budget to wages and benefits associated with in-house EMS staffing in the amount of $395,034, and wages and benefits associated with the firefighting staff in the amount of $111,714, for a total increase of $506,748.

With dollars budgeted in 2022 for the department’s operation compared against actual costs, the city would be potentially looking at a shortfall of approximately $1.8 million, he said.

Looking at a capital replacement schedule, Hatton said the department had a total of 15 wheeled assets with a total replacement value of $7.9 million. To maintain the department’s current vehicle and equipment replacement cycles, the city would need about $385,173 annually.

Bringing the operational and capital expenditures together, Hatton said in 2022, the city would require a total operating budget of $2.01 million and a total capital annual budget of $384,000, for a total cost to support fire and EMS of $2.4 million.

Looking at potential sources of money to offset those costs, Hatton said the city in 2022 would have $182,529 to contribute, with another $202,301 coming from the towns served by the department. Another $645,537 would be collected through fees charged to individuals requiring services, leaving what he defined as a “total funding gap” of $1.36 million.

The city has historically funded vehicle replacement through debt issuance and payment by debt service levy, Hatton said.

Facility maintenance and utilities associated with the department have historically been paid using the city’s general fund.

A slide shows the city’s fire and EMS operational budget and the actual dollars spent in 2021, and the original budget approved and the current expenditures in 2022. The operating statement indicates that the original budget in 2022 was set at $1,509,342 while the current expenditures are shown at $2,016,089, placing 2022 expenditures $506,748 over budget.

A balance sheet shows the replacement value of the fire and EMS wheeled assets. To continue with the department’s vehicle and equipment replacement cycles, the city would need $385,173 annually.

A slide shows the city’s “funding gap” in 2022 calculated after the city’s fire and EMS operating budget and the annual cost of capital replacement is applied against funding paid to support the service district by the city and contracting towns.

Tax levy and impacts

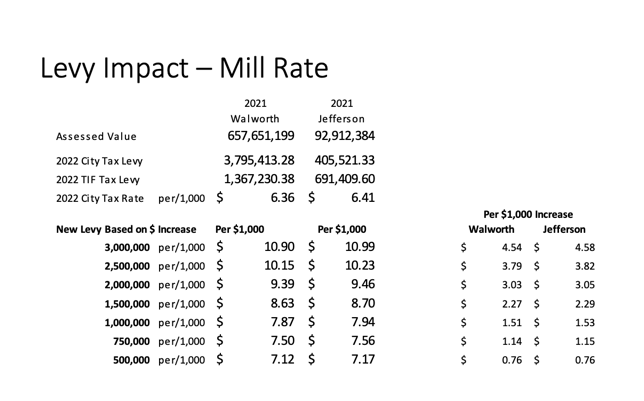

Hatton sought to facilitate an understanding of potential impacts to the city’s levy and the mill rate.

In 2021, he said, in Walworth County, the assessed value of the city’s total taxable assets was $657,651,199. The city’s 2022 tax levy was $3.8 million. In 2022, a Tax Incremental Finance (TIF) tax levy was $1.3 million. The impact to the taxpayer was $6.35 per $1,000 of assessed property value.

In 2021, in Jefferson County, the assessed value of the city’s total taxable assets was $92,912,384. The city’s 2022 tax levy was $405,521, with a TIF tax levy of $691,409. The impact to the taxpayer was $6.41 per $1,000 of assessed property value.

Looking at various estimated tax levy increases, which could be sought in November through the referendum process, Hatton produced several charts showing increases in mill rates and the associated impacts at differing levels of home value in both Walworth and Jefferson counties.

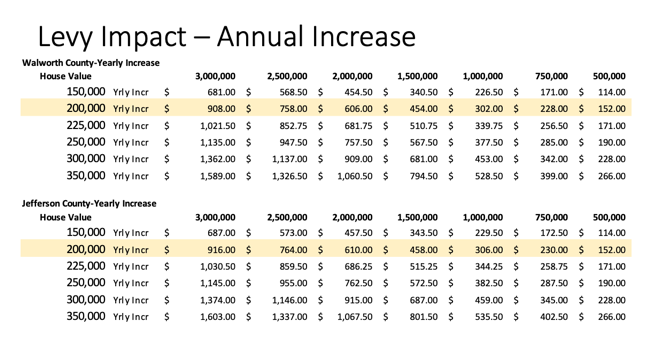

Hatton said the average home value in Whitewater is $206,000.

The slide above shows tax levied amounts assessed by the city and the associated mill rate. In 2021, city of Whitewater residents living in Walworth County paid $6.36 per $1,000 of assessed home value. City of Whitewater residents living in Jefferson County paid $6.41. The chart shows mill rate increases associated with varying tax levy amounts.

With the average home in Whitewater valued at $200,000, highlighted in yellow, the chart shows the tax impact as a yearly increase to a homeowner at varying levy amounts.

Allocation of costs

Hatton cited a need to establish an objective and transparent model to allocate costs to municipalities served by the city’s fire and EMS department. He noted that the past practice, used by WFD Inc., to allocate costs was “not well documented or understood.”

Hatton recommended that the city adopt the use of an equalized value model to allocate costs.

Equalized value is used by school districts and other jurisdictions where several municipalities share services, he said. The concept offers a means by which to allocate proportional shares. He described the process as using “simple and objective data maintained by the state and counties.”

In Addition, Hatton said, he would continue to explore other methods used by neighboring departments. He cited the North Shore Fire Department in the Milwaukee area and the City of Delavan Fire Department, which provides service to a portion of the town of Richmond, as entities he would query for advice.

Hatton next provided a slide showing in 2021 the total equalized value of taxable parcels in the city of Whitewater and the towns served by the department.

The chart offered an estimated $1.3 million which could be received through equalized value to support the costs of the fire and EMS service area.

Breaking those numbers down, Hatton said that of the $1.3 million, the city of Whitewater’s taxpayers would be responsible for $697,744. The rest would become the responsibility of the towns within the service area.

The slide shows the allocation of costs to each of the entities contracting services within the Whitewater fire and EMS service area. Of the $1.3 million available through taxation using equalized value, city of Whitewater residents living in Walworth County would be allocated $610,767 and city of Whitewater residents living in Jefferson County would be allocated $86,977.

The chart shows the percentage of the total $1.3 million each municipality within the Whitewater Fire and EMS service area is responsible for paying, related to the full cost, as a function of equalized value.

Next steps

Defining next steps, Hatton noted that the city would need to begin communicating with the towns supported by the city’s fire and EMS department to make them aware of future funding contributions.

Clapper said that while the towns were aware that the council would be making a decision regarding bringing fire and EMS services in-house, and that there could be additional future costs associated with that change, they were also aware that their contracts with the department would remain in place until the end of the year. He did not believe the towns would have the ability to bring a referendum before their voters in time to collect additional monies by November.

Hatton said that the city would need to finance the costs until the towns could decide how they would finance the increase.

He suggested that council during its next meeting establish a referendum question to bring before the city’s voters in November.

The selection of a referendum consultant to help educate the public about the need for the referendum also was included among next steps.

Members of the Whitewater Common Council and the Whitewater Fire and EMS Department, formerly of Whitewater Fire Department (WFD), Inc., gather behind Whitewater City Clerk Michele Smith, seated, from left, City Manager Cameron Clapper and WFD, Inc., Board of Directors President and Capt. Christ Christon, who signed on Thursday an agreement to bring the department in house as a city-operated service.

Members of the Whitewater Fire and EMS Department include: EMS Capt. Jason Dean, from left, Capt. Christ Christon, EMS Chief Ashley Vickers, Lt. Justin Sachse, Lt. Andy Rowland, First Assistant Fire Chief Ryan Dion and Second Assistant Fire Chief Joe Uselding. The fire and EMS personnel were in attendance Thursday at a joint meeting of the Whitewater Common Council and the Whitewater Fire Department, Inc.

An earlier story about the in-house department’s command staff is here: https://fortatkinsononline.com/whitewater-fire-ems-officials-nominate-new-command-staff/.

Kim McDarison photos.

This post has already been read 1035 times!

Kim

Our Advertisers

Most Read Posts

- No results available