By Kim McDarison

Walworth County Administrator Mark Luberda presented a proposed 2025 budget to the County Board of Supervisors at a Committee of the Whole Budget Workshop last week, according to information released by Luberda’s office Friday.

While a budgetary process has been underway for “months,” the release noted, last week’s presentation was the first time the Walworth County Board of Supervisors was presented with the budget document.

According to information found on the county’s website, counties must produce an annual budget, with that process beginning in March of each year. Budgets are adopted typically in November.

This year’s 82-page preliminary budget is found here: https://www.co.walworth.wi.us/DocumentCenter/View/15559/2025-Walworth-County—County-Administrators-Budget-Booklet-PDF.

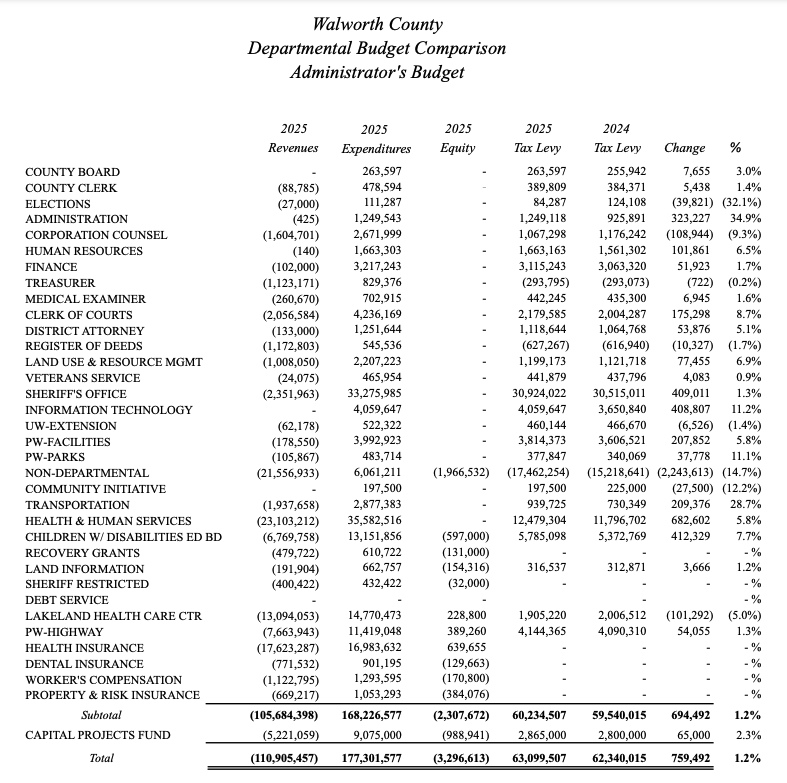

Within the preliminary budget document, the county administration is thus far projecting total operating expenditures in 2025 of $177,301,577. Last year, the administrator’s preliminary budget document presented a spending plan of $181.6 million.

County documents note that, along with monies derived through an annual property tax levy, other operational revenues used to support the county are obtained through debt transfers, program income, and state and federal aid.

The 2025 document further provides a Capital Improvement Plan beginning in 2025 and extending through to 2034.

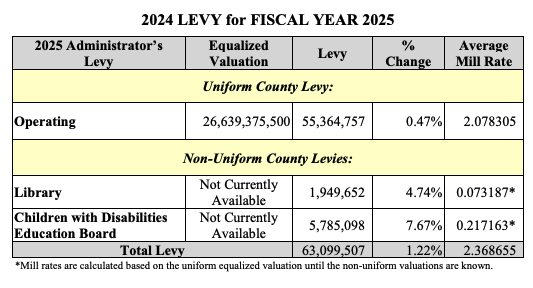

According to information provided in the proposed budget document, the operating budget is primarily funded through the tax levy. Revenues from the tax levy in 2025 are projected at approximately $63 million, which is an increase of last year’s $62.3 million tax levy of 1.2%.

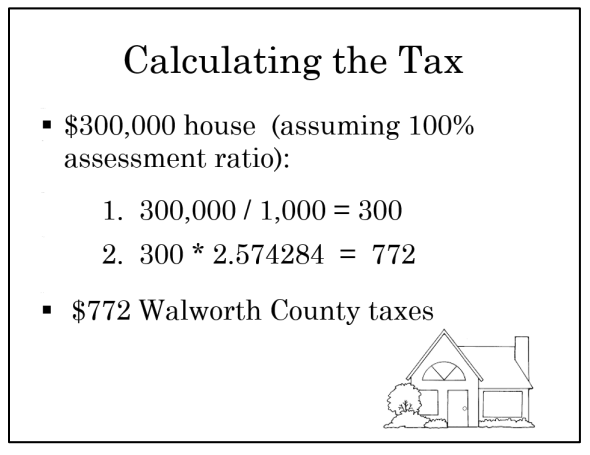

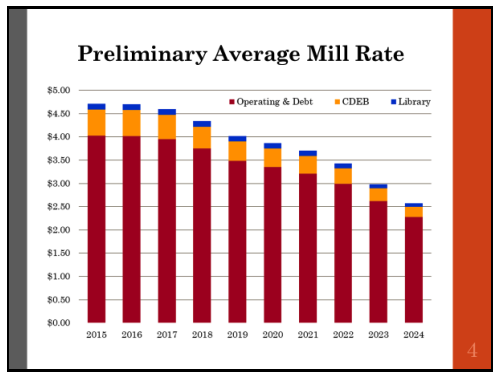

A chart within the document projects an average mill rate in 2025 for Walworth County taxpayers of 2.368, meaning that taxpayers will pay $2.368 to the county for every $1,000 worth of property value as part of their property tax bill.

The full levy paid by taxpayers includes mill rates from four taxing jurisdictions. They are the county, the municipality in which they live, the school district that serves their area, and the area technical college.

Within the preliminary budget document, the county administrator wrote: “The property tax levy is often the primary concern of individuals when evaluating the county’s budget. Given its magnitude, $63,099,507, it is the largest single revenue source in the budget.”

Additionally, he wrote: “Wisconsin has had strict levy limits since around 2011 that significantly constrains the growth of the county property tax levy to offset operations. There are exceptions and special allowances, but in general, the county can only increase its property tax levy for general government purposes by the increase in net new construction each year.

“Essentially this means that the county property tax levy for general government can only increase by an amount equal to the taxes that are to be paid by new growth that occurred during the year.”

Given such constraints, he continued, “there is a very limited increase in the property tax levy applied to the operating budget. For the typical year, the county property tax levy is, on average, approximately 20 percent of the total property tax levy paid by property owners.”

In 2025, Luberda noted, net new construction in Walworth County is 1.01 percent. Combined with “other small, state-allowed adjustments,” and levies applied for the library system and Lakeland School, the total levy adjustment is 1.22 percent, which results in a real dollars increase of $759,492.

According to Friday’s release, “This year’s budget is focused on fiscal stability and longterm operational sustainability.”

Among its key proposals is the creation of a severe weather reserve.

“This reserve will ensure that the county is financially prepared for a year with severe levels of snow and ice without committing additional resources beyond those already budgeted for an average weather year,” the release read.

Additionally, the release noted, Luberda introduced an expansion of the Capital Improvement Plan, from that of a five-year document to a 10-year planning tool.

“The longer view will ensure we keep our eye on impending projects and fund balances so that the county can continue to protect against needing debt for capital items or projects,” Luberda was quoted as saying in the release.

The proposed 2025 budget also identifies several program expansions, such as “supporting the county board’s recent efforts to engage in housing by identifying funding for a future housing initiative. Following the work of the county’s Workforce Housing Strategy Task Force, funding was recommended for a two-year pilot program proposed by the Walworth County Economic Development Alliance to enhance business recruitment and retention and establish a workforce development recruitment portal that connects local employers with potential workers,” the release read.

Further, the release stated, the proposed budget addressed the growth of the Shared-Ride Taxi Service, which, it reported, will provide more than 43,000 rides to residents this year.

“A full slate of programming takes advantage of opioid mitigation funds received from national settlements. Fully funded from these court settlements, nearly half a million dollars per year for the next six years will provide prevention and awareness, harm reduction, housing and family support, and staffing to confront the opioid epidemic,” the release announced.

Budget process and next steps

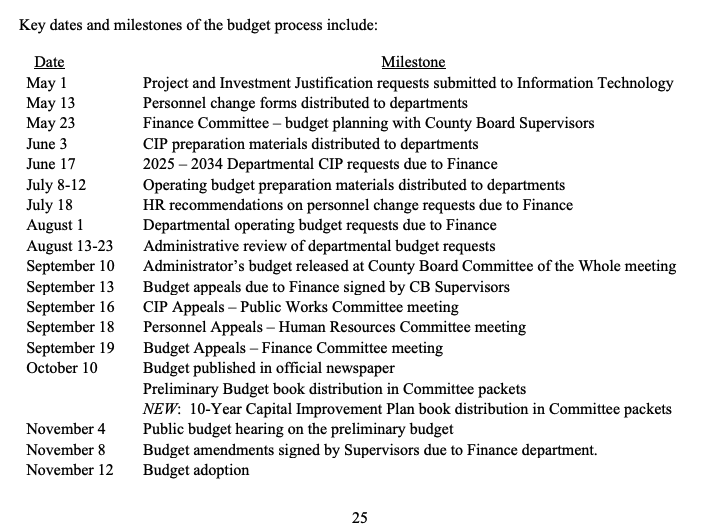

According to the release, beginning Monday, the county board supervisors will begin working with staff and elected officials to review and amend the budget at a series of standing committee meetings.

The Finance Committee will establish the county board’s preliminary 2025 budget at its meeting Thursday, Sept.19, at 10 a.m. at the Walworth County Government Center, 100 W. Walworth St., Elkhorn.

Following Thursday’s meeting, next steps include:

• Preliminary budget information will be distributed to the county board before the October committee meetings, which start Oct. 14.

• A public budget hearing will be held Nov. 4, at 6 p.m., at which time the budget will again be presented to the public, and members of the public may provide comments.

• Changes to the preliminary budget may be made by supervisors through Friday, Nov. 8.

• Formal adoption of the 2025 budget is anticipated to take place during the Nov. 12 county board meeting, which will be held at 5 p.m. Meeting schedules, agendas, and livestreams can be accessed at www.co.walworth.wi.us/agendacenter. Members of the public may also attend in person at the Government Center.

For more information about the proposed budget, including the property tax levy, visit www.co.walworth.wi.us/250/Budget.