Roundtable presenter shares affordable housing designs, cost-reducing construction options

- Home

- Roundtable presenter shares affordable housing designs, cost-reducing construction options

Roundtable presenter shares affordable housing designs, cost-reducing construction options

Editor’s note: The following is the second of a two-part story regarding a Housing Roundtable presentation and discussion held last month at the Whitewater University Innovation Center. The event was sponsored by Whitewater city officials, including the city’s Community Development Authority. The program was presented in two parts, the first of which featured Ben McKay, the deputy director of the Southeastern Wisconsin Regional Planning Commission (SEWRPC). McKay’s presentation is here: https://whitewaterwise.com/whitewater-business-roundtable-sewrpc-presenter-says-affordable-housing-likely-comes-through-smaller-lot-sizes-homes/.

By Kim McDarison

Some 60 people, all of whom had an interest in the development of housing in the city of Whitewater, gathered Thursday, April 25, at the Whitewater University Innovation Center to participate in a “Housing Roundtable.”

The two-hour, two-part program, within its first part, focused on housing demographics in Whitewater, Walworth County, and the broader southeastern Wisconsin region. Statistics were developed by the Southeastern Wisconsin Regional Planning Commission (SEWRPC), and shared during the roundtable program by the commission’s Deputy Director Ben McKay.

An earlier story about the first portion of the roundtable program, featuring information presented by McKay, is here: https://whitewaterwise.com/whitewater-business-roundtable-sewrpc-presenter-says-affordable-housing-likely-comes-through-smaller-lot-sizes-homes/.

Following McKay’s presentation, Erik Doersching, executive vice president and managing partner of Illinois-based Tracy Cross and Associates, Inc., a real estate marketing consulting firm, shared housing information as developed by his company within a presentation titled: “Residential Market Analysis; Strategy Planning Guidelines, Whitewater Wisconsin.”

Within his opening remarks, Doersching said that his company, over a period of six months, had been engaged to evaluate Whitewater’s housing market, looking objectivity, he said, to “determine what is happening, both in the conventional rental housing sector, as well as the ownership sector or the ‘for sale’ sector, (of) the market, and what the demand is, and opportunities for new construction development over the near term.”

He defined “near term” as over the next five to 10 years.

Doersching said his company conducted two housing studies, calling the first an “overview of that entire spectrum,” and more recently, he said, “we updated the rental housing sector, building a little more, looking on — again, being in the city of Whitewater, we are focusing on opportunities that exist in the conventional, rental housing market. This is not a student housing study.”

During the program, city officials said copies of the two studies referenced in Doersching’s presentation would be emailed to roundtable attendees.

Doersching described Whitewater’s student housing market as “different,” and “separate,” and “a big part of this municipality, and will remain so,” but, he continued, “what I am addressing here is demand and need for conventional rung housing to the renter households that are not in school.”

He next described his firm, noting that it does market research and residential consulting, and market studies, and housing analysis for builders and developers, which, he said, were “a lot of times … very site specific.”

He said the company worked to answer such questions as: “Hey, I’ve got this, what should I do?” or “This is my product, I’m a little concerned on the price absorption position, can you help us?”

He said the company works for municipalities and other governmental entities to provide strategic planning, and housing overviews.

He noted that he has been doing the work for nearly 35 years.

In Whitewater, he said, the goal was to form an understanding of the market trends and how they would impact future development potential. Additionally, the goal was to provide an assessment of the residential market.

Doersching said his company was unique because “in addition to being housing economists, and understanding the economics and demographics, the demand, the supply, we get really — because we have kind of a builder-developer mentality from working with them for many, many years — we get really detailed into what to do and how to do it.”

Aided by slides, as shown above, Doersching outlined “assigned goals and objectives” used in creating the studies.

Referencing materials presented by McKay, he said: “Unlike the overview we got in the previous presentation, when we surveyed, and we do all our own on-the-ground auditing, we wanted to look at the conventional sector, non-student, in both Whitewater and a broader geographic area, because Whitewater has the ability to draw from outside its area, as do other municipalities.”

Sharing a slide, shown above, offering a “snapshot” of the Whitewater market area, Doersching described Whitewater as straddling Walworth and Jefferson counties, which, he said, was considered when his company identified its study area to include a 15-mile radius, encompassing such cities as Fort Atkinson, Jefferson, Elkhorn, “and a little bit into Waukesha County as it touches upon it, and Rock, but more kind of the northern Walworth, southern Jefferson County area,” he said.

Said Doersching: “We did a survey of what we called new, or Class A, B, type of rental apartment properties that are appealing to typical workforce renter or working renter households — everything built since 2000, so that’s 24, 25 years, that is of scale, you know, like say 15 units or more. You can actually audit what they are doing — 15, 20 units or more.

“And what we found is that, unlike the masses statistic, is that that market is in an extremely tight condition, meaning the majority of those developments in the Whitewater market area are 100% occupied with waiting lists. In fact, the overall vacancy rate is 0.7% among newer developments.”

The speaker noted that very little housing product has been built, “if anything,” in the market area in the last five to seven years.

“When you even expand out, we wanted to touch and go outside of that, to areas like East Troy and like Lake Mills, or Cambridge, just to take a look, it’s equally as tight even though you’re seeing some more supply added there, but there, it’s at 1% less, so the conventional rental housing market is undersupplied … and that’s a result of the lack of product that’s been introduced for the mainstream renter and continual growth, continual household growth.”

While Doersching described growth in the market area as “gradual, or what some would consider modest,” he said the area was experiencing “years of pent up demand because of the lack of supply.”

Looking at the “for-sale sector,” Doersching said issues with supply exist there, too, and are not unique to Whitewater.

He added: “Some of what we are finding here … is very similar in almost all areas of the Midwest, so most areas of the Midwest, with similar demographic profiles — we have a housing supply issue, and that’s happening for a variety of reasons.”

He cited supply chain issues brought about initially during the COVID-19 pandemic, and the rising cost of new construction, including the direct cost of construction, along with costs associated with land, and land development, as among contributing factors, all of which, he said, “has had an impact on where homes can physically be priced.”

The situation places, he said, “whether it’s single-family (homes) or condominiums … tremendous pressure on the existing home market. What I mean by that is that the days on market are dropping dramatically. In the existing home market, you’re seeing the supply side waning in the existing home market, and what is very unique now, that I’ve really never seen in 35 years, is that the relationship between the single-family median price of new construction in this market area, (and) elsewhere throughout the suburban areas of Wisconsin, the median price between single-family construction, detached, and single-family resales, the difference between the two is about 60%. In a normal, typical market, that should be 20 to 25%, and it’s now 60-70, so there is this tremendous gap.”

Said Doersching: “Just to give you an example, the median price last year for the Whitewater market area was $412,000 for new construction, but it’s below $280,000 or $270,000 in the resale sector, $260,000 maybe, so that you have this huge gap. Usually it’s closer to 25%. So there is a disconnect right now between those two sectors.”

A slide, shown above, was used to illustrate the discussion.

He said he saw, within the “wake” of the gap, “significant opportunities.”

“I think one of the things that … let me, I’m going to skip back to demand, but this will give you a good idea of what I’m talking about. This is a great graph for understanding what I just mentioned, and I’ll bounce back and forth between rental and for-sale, but, on the right side here (he referenced the light blue section on the chart above), so that’s where between ($)300(,000) and ($)305,000 is, these are the percentages, that’s where the concentration of new construction for-sale housing, ownership housing, is happening over the last 12 to 18 months. If you take demand — and I’ll come back to those net numbers in a second — and you qualitatively distribute it, based upon people or homeowners, based upon their income, it’s up there. The two should technically match or be skewed a little bit because it is new construction. But now, here, even though there’s about a 70,000-, you know 64,000-dollar difference, between where it should be positioned, and where it is positioned, you want to maximize your market and penetrate the broadest spectrum of the for-sale market. So this is just a good example of where the current threshold of homes are being produced right now and where the for-sale housing price points would be required if you want to hit the middle of the market, which has really been lost over the last couple years.”

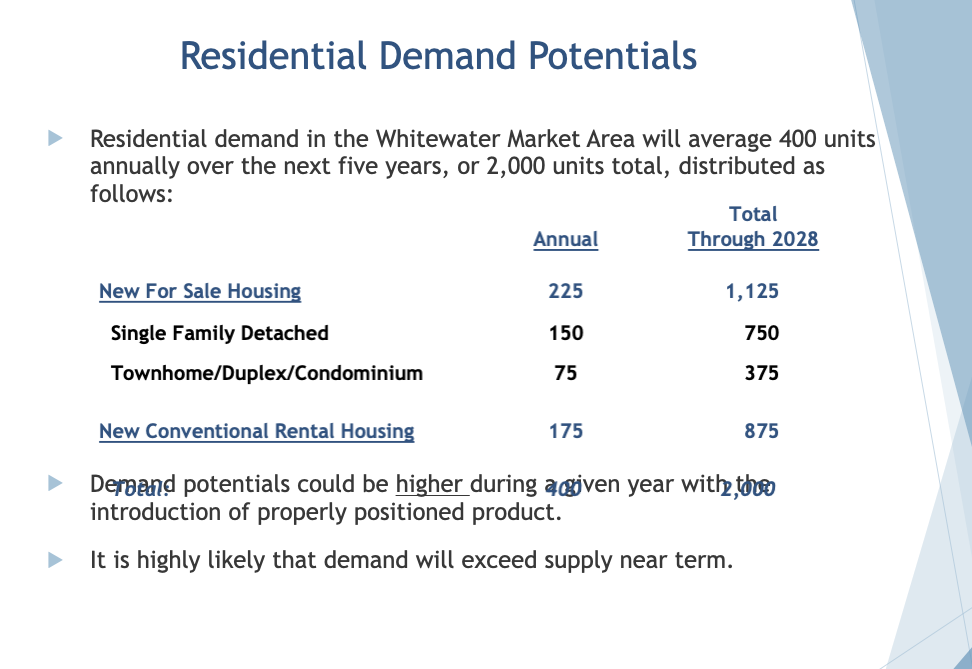

Defining “ample demand” in the Whitewater market 15-mile radius, Doersching said “2,000 total units could be absorbed with properly positioned for-rent conventional and for-sale product, through 2028.”

Pointing to a slide, shown above, Doersching said: “This is how it distributes. For-sale housing could total 225 units annually split between 150 single-family detached, 75 townhome, duplex, condominium, and 175 new conventional rental housing. And so here’s your total for the five-year period.”

Referencing the slide, he said: “Whitewater, itself, there’s two bullet points down here. No. 1, this is derived demand. So demand is derived based upon household growth, expected household growth, and the need, and taking into consideration employment growth, and the need to provide housing for that household growth.

“Replacement demand (is) to replace units lost to demolition or abandonment or attrition, etc., along with the current tighter vacancy rates, and to provide for balance in that market. So this is derived. This does not consider pent up demand, which is very difficult to measure, but we know it exists given the significance of vacancies among newer products that are in the market.”

He continued: “So what we’ve seen in other areas like this, where product has actually been brought to market, is that in a given year, you could double this, because of that pent up demand — not every year, but, all of a sudden, and it’s very hard to bring enough diversified product to market at the same time to double it, but in areas where we have seen it happen — so we just say it could be higher.

“The other side of the equation is not only could it be higher, but it’s this demand driving it that’s likely to exceed supply. Part of our overall analysis was to touch base with every planning and zoning commission throughout all the municipalities and jurisdictions for the market area, and what’s in the pipeline, … it’s not enough right now to meet this demand.”

Doersching said the result would be a situation in which “demand is going to exceed supply, near term, unless something is done about it.”

Further qualifying demand, he said: “I’m talking about properly positioned demand. If you keep producing single-family homes $400,000 and above, that’s just going to capture a component of this; now there’s a market for it, ok, at a certain sales rate and volume, but that’s just a component of this.” He adding that the market offered further penetration through the development of less expensive single-family housing.

Citing his company’s study, he said, “So what we wanted to do is, again, in the study, and I’m not going to go into great detail on looking at the demographics, looking at household growth, and age category, looking at the incomes so acutely by age group, we did all that (in the study), it’s all presented — the bottom line is, when you look at the distribution of ages, is that — and one thing that, (and) I would recommend this for almost everyone, municipality, but certainly for Whitewater, if you really want to be strategic in capturing a disproportionate share of the market area’s demand, and supply housing internally, and keep residents here, and pull residents from the future — is to try to create a hierarchy of mainstream residential products including both conventional rental housing alternatives and for-sale options.”

Doersching said the hierarchy of products he was describing does not currently exist in Whitewater.

“In fact,” he said, “you haven’t had a conventional rental development, one that’s truly targeting working renter households, for many years, and it’s showing in the tightness of that sector of the market.”

He noted that developing more rental housing targeting a workforce demographic would have “no negative impact on the student housing sector whatsoever. That functions in and of itself.

“You need conventional rental housing for your households. And even more so, you need for-sale alternatives.”

That said, Doersching continued, “it’s a lot easier said than done to hit certain price points, and we understand that. We are working with you guys, the builder-developer community, all the time … in order to bring housing, hit this demand, hit the price point, and the rent that will provide a full hierarchy across all (demographics).”

Defining the target market, he said: “Some people call it workforce housing and some people view that as a negative. Workforce housing is really just the middle of the market, it’s market-rate housing for the people that earn between 50 and 150% of the median. So we call it mainstream, or middle of the market, because it’s the same thing.”

To produce a price point and a hierarchy, he said, would require collaboration.

Pointing to a slide, shown above, he said: “I had a conductor on here, because the process needs to be orchestrated.”

Doersching said part of a collaborative effort would involve the municipality, adding: “I’m going to talk about reducing lot sizes … and increasing density for single-family homes, because it’s part of the whole process. The municipality, and because we did this for Whitewater, we’re saying you got to work closely with builders and developers to strategically — so everybody has a buy-in on where things need to be positioned.”

Doersching asked: “Now, how do we get there?”

Referencing a slide, shown above, he suggested that municipalities would need to begin to think “different in terms of land planning, densities, development and product design. You have to have a very disciplined planning approach, there’s even some incentives and concessions that might be required. We see what it takes in other municipalities, whether it’s TIF (Tax Incremental Financing) or other things. In order to actually really bring the for-sale housing market back in line with where the incomes are, or at least get it closer, you got to do some different things to do it, and density is one of them.”

Doersching described the rental market as “interesting,” because, he said, “if you look to areas surrounding the Whitewater market area, and right now garden apartments or — we’re going to talk about two products we’re recommending for areas outside and away from the university, where they can really target the mainstream of the market — it seems like rental products in other areas are being brought to market without significant effort because of the density you’re getting, because of the efficiencies in design, yet still a Class A product, you are actually able to meet the rent requirements without a lot of maneuvering.”

Addressing the for-sale sector, he said: “These are suggestions we gave into the report so that — even if all of them are not followed, if you buy into that a product line should be efficiently designed, that floor plan — that basements become optional, they don’t have to be standard — we’re seeing when that happens, in other areas … it’s being well-received, because it allows for a price point that can be met. Different densities, strong use of color to keep the products very appealing, as opposed to complicated architecture …”

Displaying different housing products on a slide, shown above, he said: “Here’s what we’re talking about. These are just illustrations of products that we see would be well-received in Whitewater.”

In the rental housing sector, he said, his company was recommending the development of two-story garden apartments with a one-car garage component, along with private entries, and direct access garages, and “ranch-villa rentals with one-car garages.”

Citing his company’s report, he said, detailed plans for each type of housing product were available, including statistics on the rent that could be achieved, and an absorption rate, “and hit and maintain stabilized occupancy of 95% or better,” he added.

Using the recommended products, he said, “offers an ability to appeal to the different types of renters that exist: single professional, or working individuals, couples, accommodate a roommate condition, people who are out of school at an early age,” and, he added, such products could help address housing for the area’s “aging” population.

He said the company has seen such products do well in such markets using one- and two-car garage configurations, and, he said, “single-level ranches, and we see this development introduced, and it absorbs immediately and there’s a 50-person waiting list right away. It is happening everywhere we see it throughout the Midwest.”

In the for-sale market, he said, his company was recommending developments which could include as many as 12 units per acre, with rear-entry garages, in the 1,200- to 1,500-square-foot range.

He described the recommended for-sale product as “very similar to what we see in the ranch-duplex or ranch condominiums, but there continues to be demand, but again, without basements … because these prices really need to be here from like $225,000 to $300,000.”

Describing a single-family dwelling placed on a single lot, he said, the home would require a “small lot,” with a “rear access garage.”

“These aren’t intended to be on 55- to 60-foot lots. These are to be on 40-foot lots, 45-foot-wide lots. It’s one of the ways that’s going to allow you to get the price point,” he said.

Looking at neighboring communities, Doersching said: “We haven’t worked with Fort Atkinson … like doing a housing study like this, but we’ve talked to them, or Jefferson, etc., and there are certain things being discussed, and developments in the pipeline, but it’s not enough to meet the demand, both in the for-sale and conventional sector. And I really believe — we saw a development, just to give you an idea, because the product’s so important, trying to take some of these recommendations and, again, if you can’t adhere to all of them, what can you do to try and bring the product back in line? Because what it means for the builder-developer is double, if not triple, the current absorption rate.

“And you’ll be filling the demand that exists in the marketplace.

“With what’s in the pipeline, and because Whitewater’s spearheading an initiative like this, there is a significant — and given the college town environment, where you are located, the regional transportation network that runs through, you’re in the position to pull demand from outside of your area, given the lack of supply that exists there, not only serve your own community, and these are some pretty significant numbers to be able to go after.”

Questions from the audience

Doersching next fielded questions from the audience, with one member asking about the impacts of immigration on the city’s housing supply.

Said Doersching: “We are focusing on really the mainstream to the higher end of the market. We have not looked at low income, this is not low-income housing. We are dealing with a certain income-qualifying group. It’s basically $40,000 a year and higher.”

An attendee asked about the impacts of placing newly constructed housing products next to existing homes, wondering how that placement would affect home values.

Doersching said that his company was often asked about the impacts of placing multifamily developments next to a single-family dwelling, adding, “We are sometimes asked: will there be a negative impact?

“So we study it. Most of the time not, sometimes, yes,” but, he said, to really answer the question the individual asking the question would need to call him and talk about specifics.

Doersching spoke about populations and growth, noting that the 65 to 74 age demographic was showing the biggest growth, but, he said, his company’s report shows growth in each age category.

“The 35 to 54 is the age group showing the slowest growth,” he said, adding that he believed those numbers could change by introducing more housing products into the market mix that would appeal to the demographic.

An attendee said that he believed Doersching was “materially off on what can actually, possibly be done … I know what’s being done in the market, you’re like $75,000 to $100,000 off,” he said.

Doersching asked the attendee to further define “off.”

The attendee said he was off on his final price points.

He added: “I mean the numbers you were quoting were product types, so, it can’t be done. Maybe it’s a Wisconsin problem, a cost problem, I don’t know.”

Said Doersching: “We are very sensitive to that because we don’t want to be unrealistic. In part, it can be, but on 55- by 120-foot lots, we’re showing closings from $353,000 to $418,000 for unit sizes from 1,750 to 2,400 (square feet), without basements, and that is with the most efficiently designed product. Having that density, getting assistance through either the land, etc., …”

The attendee responded, saying: “I don’t know of a slab on grade community north of — wherever that frostline changes. I’m all over the market, and I don’t think there’s a comp for that. I think you’re pulling data from the markets where they don’t need a frostline.”

Doersching said Washington County was an example of where such housing was being produced.

The attendee called those projects “heavily subsidized.”

The two individuals agreed that working out the details of what might be done together at a different time would be beneficial.

Additionally, the attendee said that municipalities are not receptive to constructions with garages that enter through alleyways.

“I would love it if you could get a municipality to take dedications of alleys anymore. They are never going to do it. I think we can forget about that as a possibility,” he said.

Doersching said such projects were “being done in Madison.”

The attendee agreed, saying: “In Madison, they can do it.”

Said Doersching: “It takes a collective effort.”

He said a community in Indiana created efficiencies to bring down price points after they realized they had no inventory under $300,000.

“It’s just a way of thinking differently,” he said.

“The average vacant lot in Waukesha County is $250,000. That’s not the house — that’s just the lot,” the attendee said.

“There’s not an immediate solution to this, Doersching, said, adding: “It’s one of the many reasons why the conventional rental housing market is so strong, because a lot of people, if they can’t get into the resale market, they are just going to continue to rent.”

Erik Doersching, executive vice president and managing partner of Illinois-based Tracy Cross and Associates, Inc., a real estate marketing consulting firm, addresses some 60 participants last month during a city-sponsored Housing Roundtable presentation. The speaker shared housing information as developed by his company within a presentation titled: “Residential Market Analysis; Strategy Planning Guidelines, Whitewater Wisconsin.” Kim McDarison photo.

This post has already been read 2391 times!

Kim

Our Advertisers

Most Read Posts

- No results available